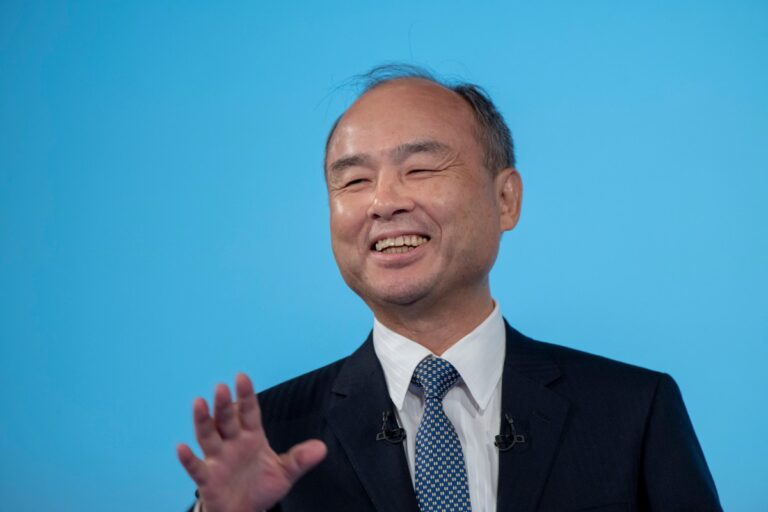

Masayoshi Son's popularity is middling. The SoftBank founder's career is littered with eyebrow-raising gambles, each one looking more outrageous than the last.

His latest move is to liquidate his $5.8 billion in Nvidia stock and focus all his efforts on AI. And while it took the business world by surprise on Tuesday, it might not be the case. It's rather surprising that the 68-year-old Son didn't push his chips to the center of the table at this point.

Consider that during the dot-com bubble of the late 1990s, Son's net worth soared to about $78 billion by February 2000, making him briefly the world's richest person. Then, a few months later, the ugly dot-com bust happened. He personally lost $70 billion as SoftBank's market capitalization plummeted 98% from $180 billion to just $2.5 billion, the largest financial loss ever for an individual at the time.

In that dire situation, Son made what would become his most legendary gamble. In 2000, he decided to invest $20 million in Alibaba after a six-minute meeting with Jack Ma. That stake would eventually grow to be worth $150 billion by 2020, turning him into one of the venture industry's most recognizable figures and funding his comeback.

Alibaba's success often obscures the fact that Son stayed at the table too long. When Son needed money to launch his first Vision Fund in 2017, he didn't hesitate to raise $45 billion from Saudi Arabia's Public Investment Fund. This was long before Saudi money was accepted in Silicon Valley.

After journalist Jamal Khashoggi was murdered in October 2018, Son denounced the killing as “horrible and deeply regrettable,” but maintained SoftBank's commitment to control of the Saudi capital, insisting it could not “turn its back on the Saudi people.” In fact, Vision Fund began trading in earnest shortly thereafter.

That didn't go very well.

tech crunch event

san francisco

|

October 13-15, 2026

The big bet on Uber cost the paper years. Then along came WeWork. Over the objections of his subordinates, Son “fell in love” with founder Adam Neumann and gave the co-working company a dizzying $47 billion valuation in early 2019, after making several previous investments in the company. But WeWork's IPO plans fell apart after the company released its famously controversial S-1 filing. Even after ousting Mr. Neumann and taking a series of harsh measures, the company never fully recovered, and SoftBank ultimately suffered $11.5 billion in equity losses and an additional $2.2 billion in debt. (His son reportedly later called it “a stain on my life.”)

Son has been trying to make a comeback for years, but Tuesday will undoubtedly be remembered as a key moment in his comeback story. In fact, this will be remembered as the day SoftBank revealed that it had sold all 32.1 million of its NVIDIA shares. It wasn't to diversify its bets, but rather to double down on other areas, including a planned $30 billion commitment to OpenAI and joining a $1 trillion AI manufacturing hub in Arizona (which the company reportedly hopes to do).

It would be understandable if Son was left with heartburn after selling his position. SoftBank exited at about $181.58 per share, which is just 14% below Nvidia's all-time high of $212.19, which looks solid. This is surprisingly close to the highest valuation for such a huge position. Still, the move marks SoftBank's second complete exit from Nvidia, the first of which came at a very high cost. (In 2019, SoftBank sold a $4 billion stake in the company for $3.6 billion. Today, that stake is worth more than $150 billion.)

The move also caused a stir in the market. As of this writing, NVIDIA's stock price has fallen nearly 3% following this disclosure, despite analysts stressing that the sale “should not be seen as a cautious or negative stance toward NVIDIA,” but rather reflects SoftBank's need for capital for its AI ambitions.

Wall Street can't help but wonder: Is Mr. Son seeing something now that others aren't? Judging by his track record, maybe so – investors are all about ambiguity.